The Don’ts: Vacation Rental Ownership (Creating Awareness)

Vacation rental markets like Aspen reward precision. A miscalculation—whether legal, logistical, or financial—can compromise the integrity of a high-value asset. Avoiding common pitfalls requires more than avoiding shortcuts; it demands a full understanding of systems, cycles, and expectations specific to Aspen mountain properties. In these elevated markets, what you don’t do can be just as consequential as what you pursue.

Table of Contents

- Don’t Overlook the Evolving Insurance Landscape

- Don’t Assume Governance Is Straightforward in Aspen

- Don’t Confuse Luxury with Livability

- Don’t Rely Solely on Peak-Season Demand

- Don’t Disregard Tiered Taxation and Assessment Triggers

- Don’t Underestimate Site-Specific Restrictions

- Don’t Base Decisions on a Snapshot

- Don’t Ignore the Aspen Market’s Forward Trajectory

- Closing Thoughts

Don’t Overlook the Evolving Insurance Landscape As it Pertains to Rental Properties

Insuring an Aspen vacation home requires more than standard homeowners coverage. Insurers now factor wildfire zones, slope instability, and increasing climate-related risk into their underwriting models—leading to rising premiums or coverage exclusions. In some high-elevation areas, policies may require annual fire mitigation inspections or proof of defensible space compliance to remain valid.

Specialized brokers who understand Aspen real estate market nuances—such as floodplain boundaries near creeks or wind exposure in ridgeline properties—can structure layered coverage that includes loss-of-rent protection and extended vacancy riders. Before closing, request a full coverage quote and ensure it reflects not just structure value, but potential income loss and relocation costs during a repair or rebuild scenario.

Also, it’s recommended to consider damage protections if you decide to monetize the property in the rental pool. There are many providers out there, including the damage protection offered by many distribution channels like Airbnb or VRBO. If you’re professionally managed, consult the manager on additional options. While you’re at it, ask them about additional coverages like trip and fall or bed bugs.

Don’t Assume Governance Is Straightforward in Aspen

In Aspen, legal frameworks around land use, occupancy, and ownership rights evolve quickly. Many new buyers enter the market under the assumption that short-term rental eligibility is guaranteed, only to discover that neighborhoods operate under moratoriums, quota systems, or overlay districts where permits are capped or suspended.

Beyond STR-related restrictions, certain Aspen HOAs now impose usage limitations based on noise complaints, traffic patterns, or even guest parking density. Some have implemented rotating blackout months for rentals or increased guest vetting requirements. Reviewing CC&Rs is not enough—buyers should examine recent amendments, enforcement actions, and upcoming board votes that could signal restrictive shifts ahead.

For more information read our other blog post below or visit city resource websites:

- https://www.aspen.realestate/blog/rental-acquisition-strategy/#regulations

- https://aspen.gov/1407/Short-term-Rentals

- https://aspenchamber.org/membership/your-chamber-info/boards-and-committees/public-affairs-committee/str

Don’t Confuse Luxury with Livability

High-end aesthetics don’t always translate into guest or owner satisfaction. A property may feature designer finishes and striking architecture, but lack operational features that impact daily comfort—like zoned heating, cross-ventilation, or practical mudroom access for ski gear. Particularly in Aspen with strong seasonal extremes, homes require thoughtful design that supports function, not just form.

Modern Aspen vacationers also expect connectivity and efficiency. Homes in canyon areas or on forested lots may have limited cell reception, and older builds often default to satellite internet—insufficient for remote work or streaming. Anticipating these challenges and investing in mesh networks, boosters, or fiber upgrades adds value for both rental guests and long-term usability.

Don’t Rely Solely on Peak-Season Demand

While winter draws the most attention in ski markets, occupancy patterns have diversified. Guests now travel for summer concerts, fall foliage, and wellness retreats—creating year-round potential for well-positioned homes. Relying exclusively on winter income ignores opportunities to stabilize cashflow during shoulder seasons.

Homes that perform well across the calendar often feature adaptable outdoor spaces, flexible bedding configurations, and proximity to non-ski amenities like trailheads or cultural venues. Building a dynamic marketing plan that targets different guest segments—families in summer, couples in fall, remote workers in spring—positions the home as a year-round asset rather than a seasonal commodity.

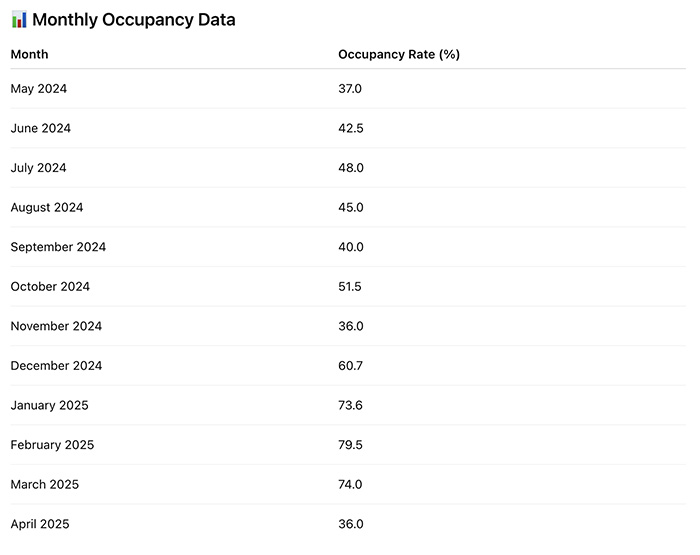

Here is an Occupancy Table to Elaborate on Aspen’s Demand. As you can see some months are more aggressive than others. Also, keep in mind Occupancy is a singular KPI, the more important indicator is Average Daily Rent (ADR). In other words; your Aspen's rental performance = Occupancy X ADR.

Sources: Aspen Chamber Monthly Research Updates; AirDNA; Airbtics; AirROI.

Don’t Disregard Tiered Taxation and Assessment Triggers

Beyond Aspen’s property taxes, ownership in communities may trigger layered assessments tied to tourism, infrastructure, or environmental impact. In Aspen, some STR approvals require payment into affordable housing funds or tourist impact mitigation programs—fees that can total thousands annually. Others assess a “luxury surcharge” for homes over a certain valuation, especially if they’re rented commercially.

Buyers should request a property-specific tax breakdown during due diligence, including STR license costs, nightly occupancy taxes, and any district-specific levies. Not all fees are recorded on tax rolls—some are billed by property managers or HOA administrators after permits are issued. Understanding this cost stack is essential to modeling net income and setting competitive rental pricing.

Don’t Underestimate Site-Specific Restrictions

While Aspen’s zoning maps offer a macro view, the reality of what can be done with a parcel often hinges on topography, easements, and environmental overlays. A home on a ridgeline may fall within an FAA-protected view corridor, limiting roof height or exterior lighting. Parcels near streams or wetlands may face state-level permitting for any ground disturbance, even for landscaping.

Recent land-use code changes in resort towns have also introduced stricter energy and water efficiency standards for remodels and additions. Buyers planning to customize or expand should verify whether the property can meet new build codes without triggering additional environmental reviews or penalties.

Don’t Base Decisions on a Snapshot

An Aspen property that seems ideal in high summer may reveal a different character come winter. What appears to be a quiet, sunlit location could become shaded, slippery, and difficult to access once snow arrives. In spring, runoff may expose drainage issues, basement seepage, or erosion in sloped driveways.

Rather than relying on a single-season impression, request seasonal utility records, snow removal logs, and neighbor feedback. If visiting during off-peak months isn’t possible, potentially ask for seasonal inspection reports. Understanding how the home performs across major seasons is necessary for both livability and rental planning.

Don’t Ignore the Aspen Market’s Forward Trajectory

Immediate rental potential is only part of the equation. Long-term value in vacation markets hinges on infrastructure momentum, community investment, and resort master planning. Areas adjacent to new Aspen lift expansions, revitalized base villages, or improved public transit typically see appreciation well ahead of formal completion.

Track permitting activity, resort development announcements, and municipal planning agendas to anticipate which corridors are likely to emerge. Even if a property feels “fringe” today, proximity to future amenities—such as a new gondola station or luxury hotel—can transform its position in the market. Insight into these trajectories adds strategic depth to any acquisition.

Closing Thoughts

By staying informed and forward-thinking, investors can capitalize on evolving resort markets and position themselves ahead of trends. Recognizing the potential of both current hotspots and emerging areas ensures not only smart acquisitions but also long-term value growth. With careful research, strategic timing, and a keen eye for developing opportunities, seizing the right investment can lead to significant returns in this dynamic and rewarding sector.

If you need help navigating Aspen's real estate market, please contact Ryan Schwartz today. Ryan is known for his expert knowledge in the Aspen market and is a vacation rental owner himself.

Leave A Comment